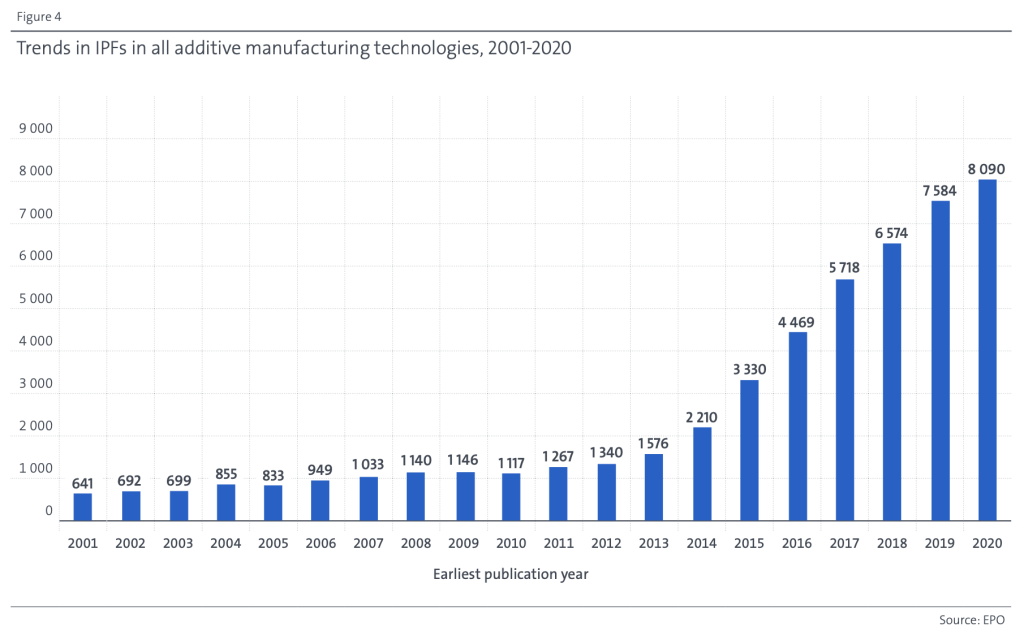

According to European Patent Office (EPO) data, between 2013 and 2020 the global number of patent applications for additive manufacturing technologies grew eight times faster than all other technology fields as a whole.

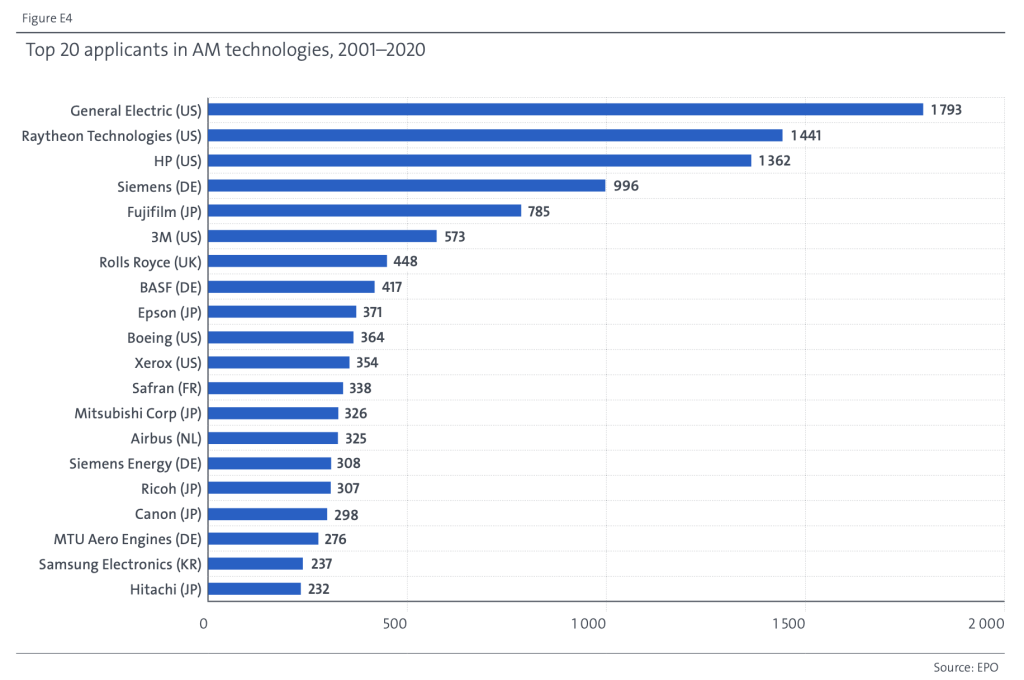

Is it a surprise that the “world’s largest aerospace and defense company” is also leading the rankings in terms of 3D printing patents? Virginia-based missile system manufacturer Raytheon Technologies (RTX) placed second only to General Electric (GE) in terms of additive manufacturing patent applications. RTX submitted 1,441 international patent family (IFP) applications during the period, with GE submitting 1,793.

“RTX is an innovation company at its heart,” explains Venkat Vedula, an executive director at the Raytheon Technology Research Center. “We patent technologies in areas like AM to protect the value of our significant, long-term investment in technology to maintain our competitive edge.”

Both GE and RTX, although not purely focused on 3D printing, have contributed to notable additive manufacturing innovations.

RTX has previously worked with software developer Hexagon to create a platform that predicts and prevents part defects in metal 3D printing, and has developed 3D printed military optics for the US Department of Defense.

GE actively develops 3D printing technology through its GE Additive division. In 2022, GE Additive launched the Series 3 binder jet platform, its latest industrial binder jet 3D printer. Additionally, GE’s 3D printed fuel nozzle tip generated a lot of attention within the aerospace industry upon its launch in 2017.

Rounding out the top three of the EPO’s patent applicant leaderboard is multinational printing firm HP.

“HP Inc. patent strategy is to protect our innovations. Introducing brand new and disruptive printing platforms to the world has driven the need for a broad and large number of patents,” says Dr. Tim Weber, Vice President of 3D Metals R&D at HP.

Most of HP’s patents are for its 3D printers, supporting the company’s proprietary Multi Jet Fusion and Metal Jet technologies. HP launched its newest Metal Jet 3D printer, the S100, at the 2022 International Manufacturing Technology Show (IMTS).

“We patent HP’s Intellectual Property for our Hardware Systems, printing processes, printheads and agents (Fusing, Detail, Binder), Workflow, and materials,” adds Weber. “We have introduced systems and evolving platforms for both polymers and metals that have kept a steady stream of patenting.”

Additive manufacturing patenting outpacing the tech sector

Between 2001 and 2020, the global number of patent applications for additive manufacturing technologies grew at an average rate of 26.3%, compared to 3.3% for the rest of the tech sector.

Overall, patent applications from over 50,000 IPFs relating to additive manufacturing have been filed worldwide. 8,090 additive manufacturing related IPF applications were published in 2020 alone, a five-fold increase compared to 1,576 in 2013.

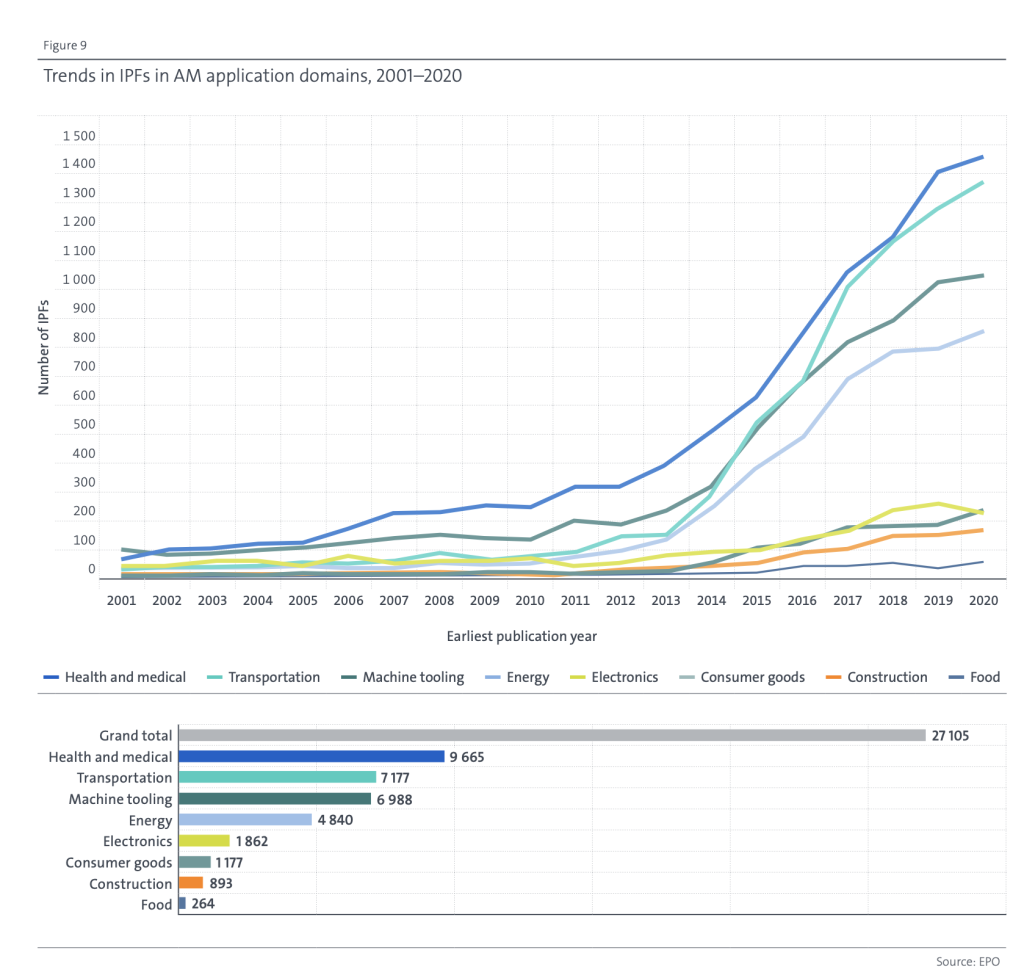

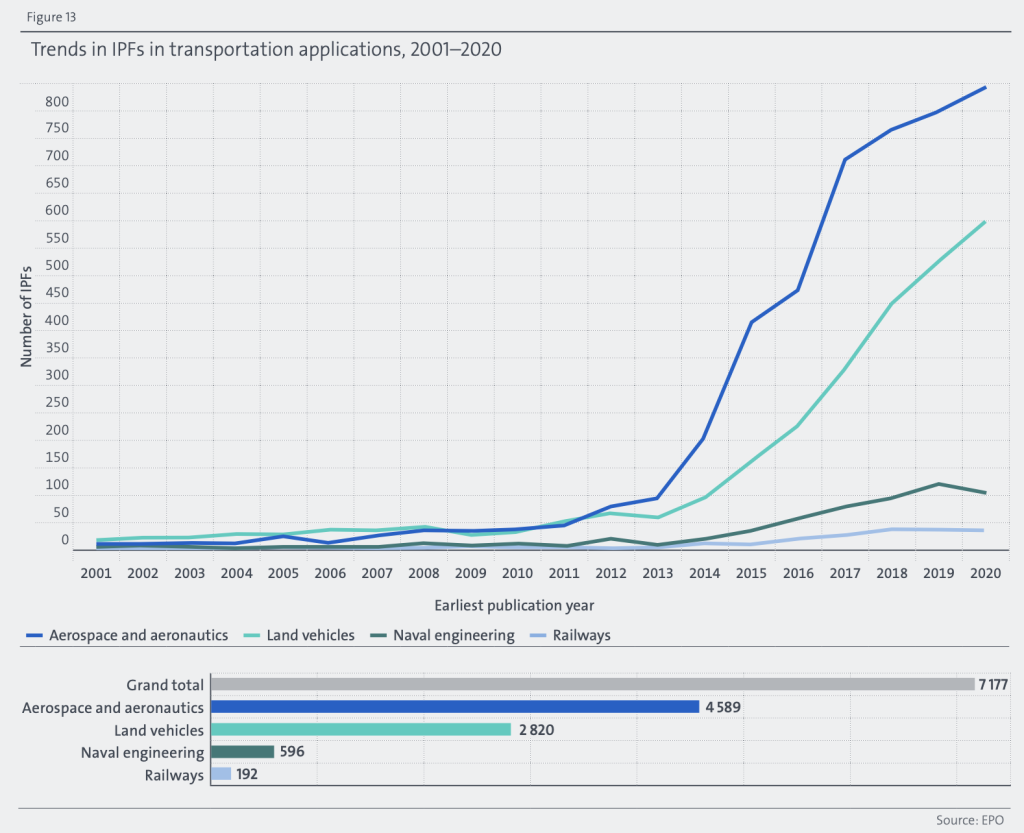

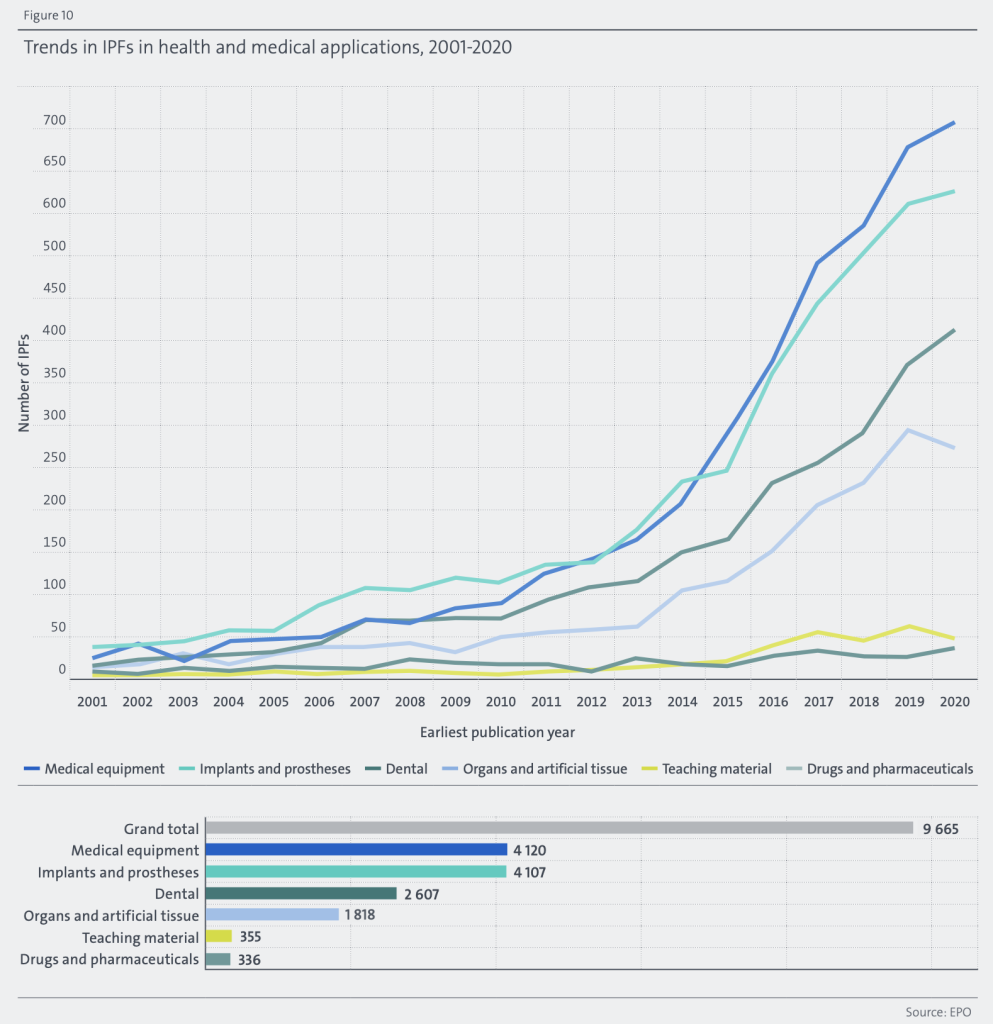

The EPO pointed to the medical and transportation (aerospace and automotive) sectors as leading the way for 3D printing patent applications. Over 7,000 additive manufacturing IPFs were published within the transportation sector, and 10,000 within the health and medical sector.

These findings reflect the responses to 3D Printing Industry’s survey on 2024 3D printing trends. 3D printing experts highlighted the growing adoption of additive manufacturing for the production of healthcare and dental devices, as well as the transformative impact of 3D printing in aerospace and defense industries.

António Campinos, President of the EPO, stated that the study points “to a world in which the pace of innovation in AM technologies has accelerated dramatically over the past years.”

However, the relationship between patents and innovation is not clear cut. In an interview with 3D printing Industry regarding 3D printing and intellectual property (IP), John Hornick argued that IP can negatively impact technological innovation within additive manufacturing. A report from the US Congressional Budget Office has also highlighted that “low-quality patents,” patent litigation, and an increasing number of patent trolls can harm innovation.

Patent pendency, the time between a patent filing and the granting of the patent, can also pose challenges. The EPO has a lengthy mean patent pendency time of 5.87 years. Whilst a company can start using a technology as soon as it invents it, it must wait for a 3D printing patent to be granted before it has protection.

Accelerating AM patent applications in aerospace

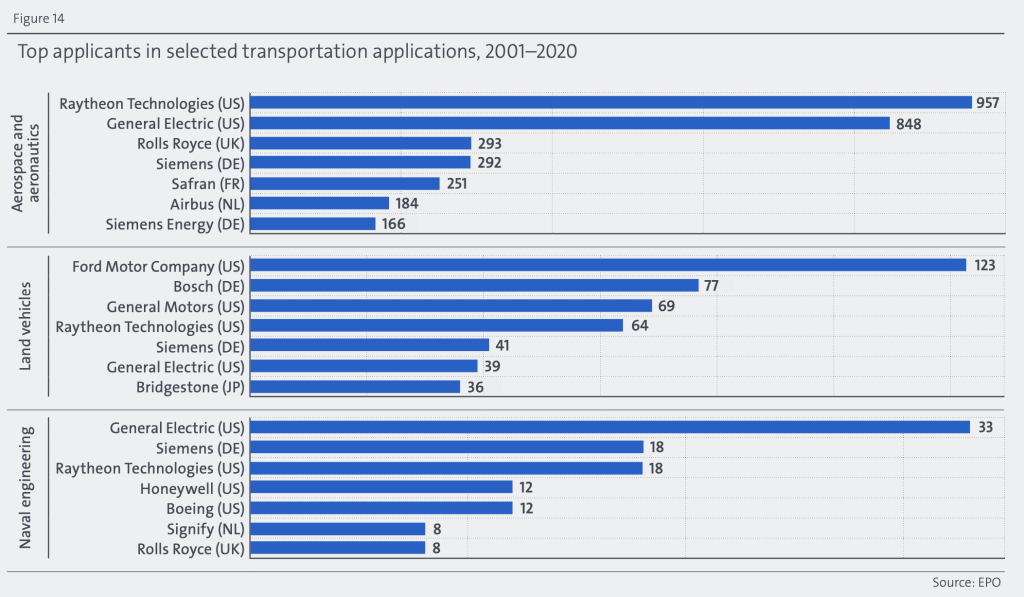

Aerospace and aeronautics saw 4,585 3D printing patent applications between 2001 and 2020, according to the EPO study. The role of additive manufacturing within this sector has accelerated, with IPF applications per year surging from under 100 to over 700 between 2013 and 2017, reaching 834 in 2020.

What has driven this acceleration? François-Xavier Foubert, CEO of aerospace manufacturer Safran’s Additive Manufacturing Campus, highlights the need to differentiate from the competition. Intending to achieve the “best-in-class additive manufacturing technology,” Safran applied for 251 aerospace and aeronautics IPFs during the first two decades of this century.

According to Foubert, “In order to provide the best added value to Safran products and therefore to our customers, we are making a huge effort in research and technology (R&T) to be a leader in adding the benefits from AM technologies into our products.”

“The range of technologies associated with additive manufacturing is increasing year after year,” adds Foubert. “To capture all relevant technologies, we had to accelerate our R&T and research and development (R&D) efforts.”

Aircraft engine manufacturer MTU Aero Engines applied for 276 3D printing patents during this period. The company’s Director of Additive Manufacturing, Dr. Jürgen Kraus, believes that “AM will be a game changer in production engineering, enabling many design improvements such as weight and fuel burn reduction.”

The majority of MTU’s 3D printing patents relate to aviation propulsion systems, with a distinct focus on quality assurance, online monitoring with optical tomography, improvement to the Laser Powder Bed Fusion (LPBF) process, and design optimizations.

RTX’s aerospace-related patent applications mainly focus on Powder Bed Fusion (PBF) and Directed Energy Deposition (DED) processes.

The company pursues patent protection in areas where additive manufacturing enables a specific use case, such as substitutions, unitization, design optimization, sustainment or aftermarket.

3D printing patents soar in medical sector

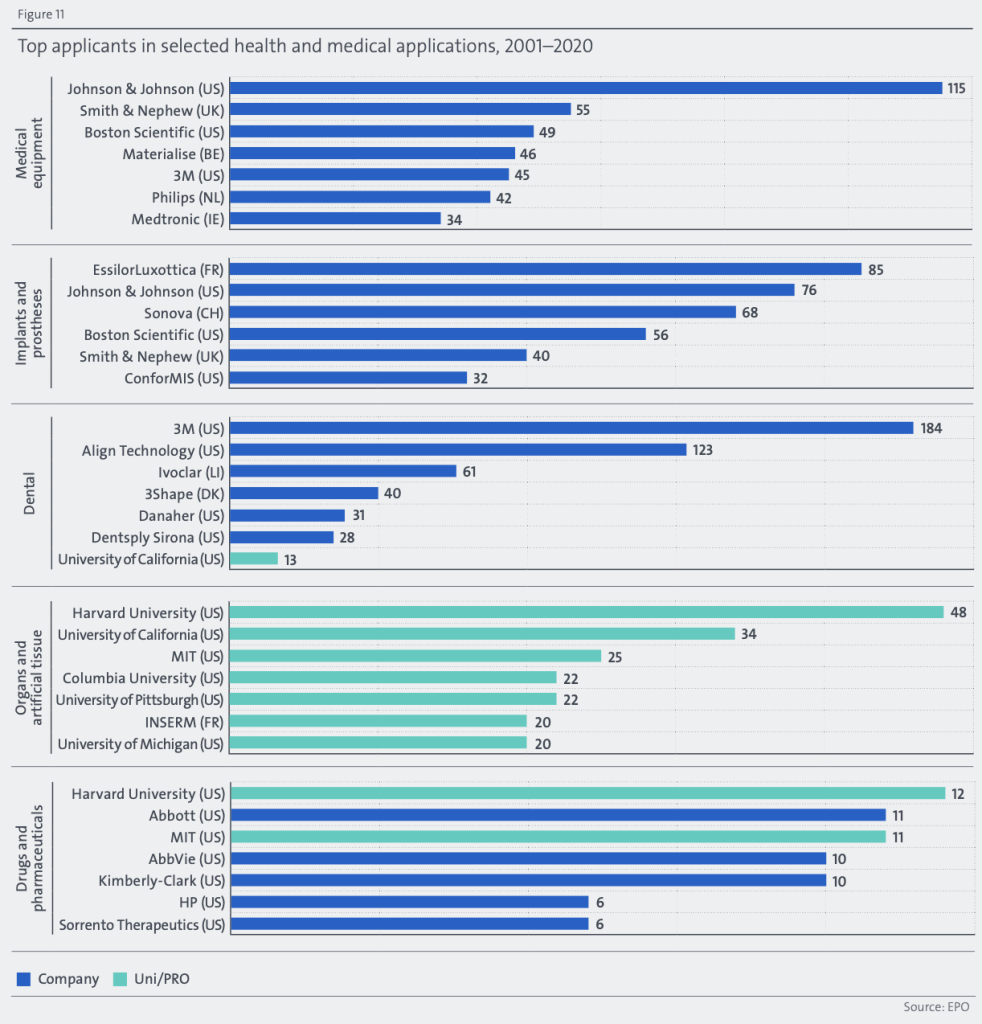

Within medical and health, the EPO highlights notable growth of 3D printed medical equipment, implants, and prostheses in patent applications. Over 4,100 IPFs were published for additive manufacturing technologies related to each of these medical applications.

For instance, leading pharmaceutical company Johnson & Johnson (J&J) submitted 115 IPF applications within the medical equipment sector, with patents protecting inventions such as customized surgical instruments. J&J also led the way in the implants and prostheses field, with 76 additive manufacturing IPF applications.

In the field of eye care, eyewear manufacturer EssilorLuxottica applied for 85 3D printing related patents for its specialist optical lenses.

Elsewhere, the 3D printed custom-fit hearing aid applications have seen growth. Swiss hearing care company Sonova applied for 68 IPFs, which include patents for its personalized 3D printed hearing aid shells. The firm introduced the world’s first 3D printed titanium hearing aid back in 2017.

Dental applications generated notable interest with 2,607 3D printing IPFs. 3M, Align Technology, and Ivoclar were the top three dental 3D printing patent applicants.

Developments in 3D printed organs and artificial human tissue have also been prevalent, seeing 1,818 patent applications between 2001 and 2020. Harvard University topped this table, submitting 48 related patents.

The University continues to pursue organ 3D printing research. Most recently, researchers from Harvard’s Wyss Institute 3D bioprinted multi-layer functional heart tissue using a bioink containing contractile organ building blocks (OBBs) and patient-specific stem cells. The team hopes that these findings will eventually enable 3D printed heart tissue replacements.

Subscribe to the 3D Printing Industry newsletter to keep up to date with the latest 3D printing news. You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.

Are you interested in working in the additive manufacturing industry? Visit 3D Printing Jobs to view a selection of available roles and kickstart your career.

Featured image shows the top 20 additive manufacturing EPO patent applicants between 2001 and 2020. Image via the European Patent Office.