Boston Micro Fabrication (BMF) has positioned itself uniquely in the 3D printing sector, filling a gap for ultra-high resolution 3D printing with a focus on Projection Micro Stereolithography (PµSL). This additive technology, with its emphasis on precision and dimensional accuracy, was inspired by the void in the market between existing DLP (Digital Light Processing) and nanotechnology-based companies.

I spoke to John Kawola, CEO of Boston Micro Fabrication, to learn more.

How does Projection Micro Stereolithography work?

Kawola explained, “We’re top-down DLP, so we have a vat of resin and a DLP Projector on top. We have high precision optics in between to really focus the resolution and then we move the vat at a very high machined tolerance, like half a micron.” He further emphasized, “Our target market is people who care about plus or minus 10 microns, who are trying to produce a 50-micron hole.”

To put this in context, DLP is a form of vat photopolymerization 3D printing technology, often lauded for its speed and high resolution. However, the technology has its limitations, particularly when it comes to accuracy at the edges of the print area. BMF’s innovation, moving the vat rather than the DLP engine, offers an effective solution, providing enhanced resolution and accuracy even at the fringes.

BMF’s technology was initially developed in Shenzen, China, in 2017, before it launched globally three years ago. Since then, it has managed to raise significant funding and deliver around 350 systems worldwide. Its primary clientele consists of industries involved with small parts requiring high resolution, including electronics, connectors, medical devices, and life science applications. Existing customers with already established 3D printing infrastructure find BMF’s technology a useful addition for creating scaled-down prototypes. A solid third of these customers have shown interest in using the technology for production purposes.

As the industry grapples with the challenge of shifting from prototyping to production, BMF has found a niche with small parts, which are traditionally more challenging to produce using conventional manufacturing methods.

“The smaller the part gets, the more difficult it is to make conventionally,” says Kawola, indicating that 3D printing might just be the solution for such intricate requirements. However, he cautioned, the parts produced need to meet high standards of accuracy, strength, and material suitability, while the economics and operational ease also need to be viable.

Applications for high-resolution 3D printing

Boston Micro Fabrication offers its technology via five variants of the microArch 3D printer, with a range of build volumes possible, and options to 3D print in ceramics or polymers. But how is the technology used?

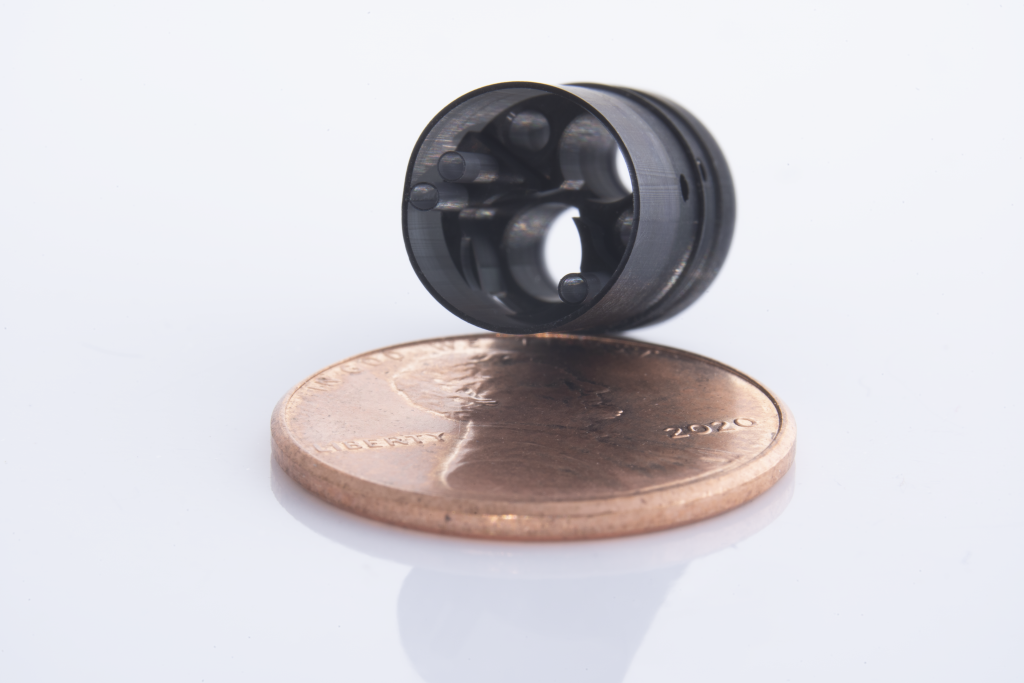

One example the BMF CEO highlights is the ongoing development of new surgical tools by companies such as the Netherlands-based IMcoMET. This company has developed an innovative skin cancer biopsy and treatment device. “It’s essentially a small microfluidic device, and then two stainless steel needles that they inserted into the part,” Kawola explains. The size of the microneedles coupled with the microfluidic device allows work to be performed in the tumor microenvironment, removing the camouflage that protects cancer cells from a patient’s immune response.

Kawola mentions the considerable impact 3D printing is having on the electronics industry. As we move from 4G to 5G and even towards 6G millimeter wave-type applications, the accompanying design constraints necessitate smaller components, including antennas, spacers, and insulating materials. 3D printing’s unique ability to accommodate these needs is changing the way we think about electronic manufacturing.

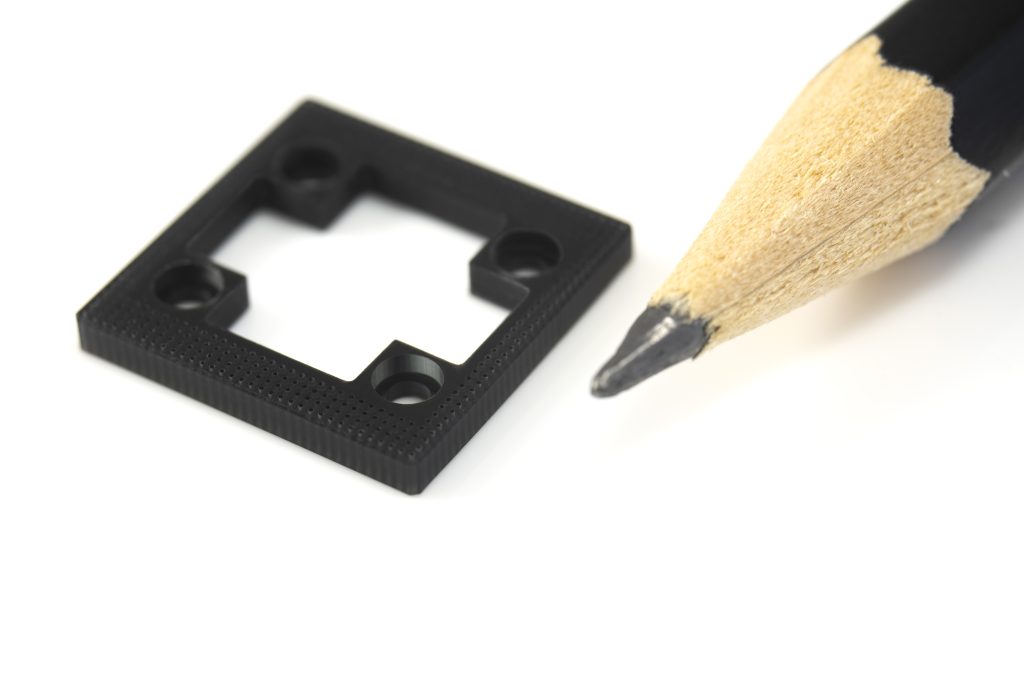

In the realm of semiconductors, BMF may not be involved in creating the chip or active components, but they are “involved in a lot of the infrastructure around the chip,” Kawola says. This includes chip packaging, lens holders, and chip sockets. These sockets, often machined from plastics such as Delrin, are used for testing chips. With 3D printed alternatives, it’s possible to achieve tolerances matching those obtained from micromachining, a feat traditionally challenging for other 3D printers.

BMF’s technology is also finding applications in Augmented Reality (AR) and Virtual Reality (VR) devices. While they don’t produce the sensors or cameras, they are integral in creating the necessary infrastructure and packaging around these components.

But it’s not just about creating smaller, more efficient electronics. Kawola outlines compelling cases for AR in areas like surgical training and warehouse order fulfillment. The latter might seem simple, but as Kawola points out, an augmented reality system can guide warehouse workers, showing them what to pick and where to place it, significantly boosting productivity.

Micro ceramic 3D printing and leveraging a macro-trend

Boston Micro Fabrication operates in the niche realm of high-precision 3D printing, with applications in a broad array of industries that demand this level of exactitude. But the total addressable market is far from small.

“We look at markets that generally require this level of precision and tolerance,” says Kawola, citing electronics, medical devices, life sciences, and optics and quantum photonics as key segments. Despite not targeting the entire connector market, a sizeable chunk of smaller connectors and ‘fast movers’ present intriguing opportunities for Boston Micro Fabrication.

By crunching the numbers, the company has calculated its total addressable market as around $3 billion, no small sum in any industry, particularly for a specialized operator like Boston Micro Fabrication. This estimate does not simply focus on the size of the aforementioned sectors but also encompasses the micro-manufacturing techniques currently in use, such as micro-injection molding, Swiss machining, and various photolithography techniques. By considering the size of these industries, Boston Micro Fabrication identifies a significantly larger market opportunity.

However, what makes this market opportunity even more enticing is the prevailing trend toward miniaturization in various fields, from medical devices to electronics. “There’s a macro trend here, that things aren’t getting bigger, they’re getting smaller,” notes Kawola. An example he gives is the evolution of cell phones, stating, “There’s way more stuff in this phone than there used to be. There are more antennas. There’s a greater set of features and electronics than there ever was.”

Boston Micro Fabrication’s work with photonics, the technology in which light is used to measure or manipulate materials, is another significant field of interest. According to Kawola, the industry’s continual push towards miniaturization impacts this field too, with smaller components such as the LIDAR array in front of the laser or the packaging for the sensor becoming increasingly important.

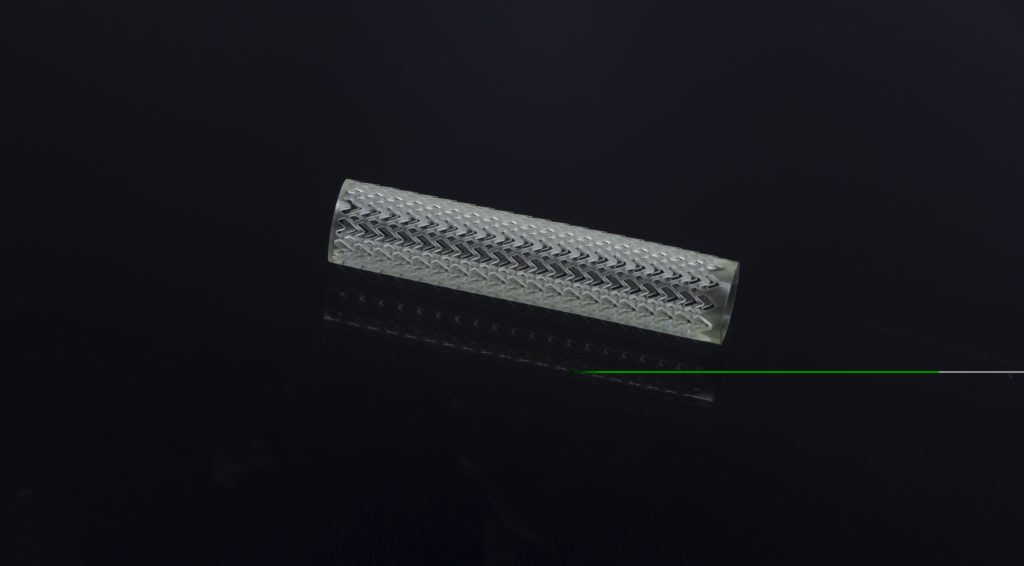

One intriguing application Boston Micro Fabrication is involved in is ceramic 3D printing. Primarily used in high-temperature or highly abrasive environments, ceramics are particularly effective for applications like nozzles, where consistency and the ability to withstand abrasion are paramount. Ceramics are also favored in certain electronic applications due to their insulating properties and high-temperature resistance.

However, ceramic 3D printing is not without its challenges. “The world has pretty much figured out how to 3D print polymers and to be able to control that tolerance well,” explains Kawola. But when it comes to ceramics, complexities arise, such as the need for debinding and sintering processes, and the material’s tendency to shrink by 15 to 20%. This learning curve makes the technology a better fit for customers who already have experience working with ceramics.

As for high-temperature applications, Kawola points out that these typically fall within the electronics industry, where components need to withstand temperatures of 200 degrees Celsius or higher without deforming over time. Regardless of whether these components are destined for industrial or consumer use, the thermal management of devices is critical. “There has to be a whole design element around thermal management,” Kawola points out, “where does the heat go, and how do they dissipate the heat, and anything that’s in the device now has to hold up to the heat that’s in there.”

A 3D printing business model

A major point of conversation for 3D printing revolves around scale, a matter John Kawola, CEO of Boston Micro Fabrication, readily acknowledges. According to Kawola, his company’s build volume sits at a comparatively modest 100 by 100 millimeters. “The key,” Kawola explained, “is to ensure the part needs to be relatively small, where you could fit hundreds on a build plate.” For them, this is the sweet spot between efficiency and productivity. A machine that can make 10,000 of these small parts in a month becomes viable and appealing to production customers.

When asked about current trends in the 3D printing industry, Kawola highlighted the immense growth the sector has seen over the last decade, transforming from a billion-dollar industry to a ten billion-dollar one. This progression, in his view, signifies the acceptance of 3D printing as a prototyping tool poised to move to the next level. Aided by advances in speed, materials, and processing power, the industry has been able to unlock manifold manufacturing applications.

Yet, there is also a flip side to this proliferation of options. With so many companies offering everything from desktop FDM machines to million-dollar metal sintering systems, Kawola notes the field is increasingly crowded, making differentiation a paramount concern for players in this space.

The CEO of Boston Micro Fabrication cites his company’s distinctiveness as a key strength. They operate in a high-growth area, seeing minimal competition and solid gross margins, affording them a choice in terms of profitability. “I think for companies to survive, they need to be differentiated and offer a product that they can charge enough money for that they can build a business around,” Kawola added, highlighting the market’s saturation.

Kawola’s insights raise a complex question: As the world of 3D printing expands and evolves, how will companies navigate the challenges of scale, differentiation, and profitability to secure a sustainable future in the industry?

“The bigger companies who are active in additive typically have a few people who are real experts. They typically have a team of people who spend time sorting through the technologies, putting all the technologies through its paces,” he said. But, Kawola admits, for the smaller, newer companies without such resources, the selection process can be challenging.

This highlights an intriguing facet of the additive industry—companies need to have an internal team of experts to fully utilize the technology, and perhaps the industry needs to evolve in a way that allows users to readily access the right technology for their needs.

To this end, BMF’s growth strategy seems primed for today’s fast-paced markets, focusing on building applications alongside customers while remaining open to doing it on their own. Kawola emphasized, “We have a whole process in place, which is around identifying these high-value applications, where we believe our technology can uniquely enable that application.”

A testament to this approach is BMF’s expansion into San Diego, focusing specifically on the life science industry and lab-on-a-chip technology. “We have a number of projects. Some are with customers, and some are on our own. We’re developing components, that I think can be uniquely enabled by our technology,” said Kawola.

This proactive strategy contrasts with the traditional industry approach, where 3D printing technologies are mainly tools for others to develop their products. BMF seems to be carving a new path—involved not just in enabling but in the development of products.

Reflecting on the 3D printing industry

Kawola’s past experience as a seasoned executive in the additive manufacturing industry lends a certain weight to his insights. Reflecting on the evolution of the sector over the past 25 years, he observed, “There were things that were happening that I think a lot of people in the industry, including myself, probably dismissed… but I think that that was disruptive, and that changed the industry.” His example was the rise of MakerBot, its earlier iterations constructed from wood, initially dismissed as a novelty but eventually spawned a whole new consumer-facing segment of the industry, now often referred to as the desktop 3D printer market.

He also pointed to the emergence of companies such as Ultimaker that filled the gap left by MakerBot’s operational missteps. The lesson drawn from such industry upheavals is clear: technological disruptions, however modest their beginnings may seem, should never be underestimated.

Applying this perspective to current trends, Kawola brings up the potential of binder jetting of metal, a technology that has attracted significant investments from firms like Desktop Metal and HP. He conceded that the technology is indeed difficult to master, but maintained that if it does work, “it will be disruptive,” citing the potentially transformative speed, scale, and volume of the process.

“I think we’re building some brand recognition, building some reputation. And a lot of it’s about execution, and how well we execute.” He referenced the Ultimaker-MakerBot saga as a cautionary tale about execution missteps and as a reminder of the need to deliver consistently high-quality products and services.

An underpinning theme during the course of my conversation with John Kawola was the idea of market consolidation and growth. Kawola reflected on a wave of consolidation that happened about a decade ago. He reasoned, “We all started staring at each other and said, ‘How do we do this?’ We all have our own sales forces, marketing, and exclusive resellers, which weren’t efficient. That’s what prompted the mergers.” Today, these larger companies boast a “whole store worth of technologies”, but the issue of sorting through these for resellers and customers remains.

This conundrum extends to the crowded 3D printing sales channel, where Kawola sees challenges for newer entrants. “The channel is carrying a lot,” he says. Boston Micro Fabrication, with its higher-end technology, has found success in selling directly, giving them a deeper understanding of their product’s capabilities.

Maintaining a direct connection with the end users is another advantage of this strategy. Kawola agrees, “We have a pretty deep understanding of what we can do and what we can’t do in terms of geometry, parts, or materials the customer is looking for. And we don’t have that sort of filter in between.”

As we wrapped up our conversation, I inquired about the AM Forum in Berlin. While Kawola won’t personally be attending, Boston Micro Fabrication will be represented. Kawola assures, “If you look at our website, you can get a little bit of an appreciation for the parts, but seeing them live is usually more impactful.” And indeed, as this industry evolves and new technological developments come to life, the tangible value of the printed part, the physical manifestation of an idea, is what continues to resonate with onlookers and customers alike.

What does the future of 3D printing for the next ten years hold?

What engineering challenges will need to be tackled in the additive manufacturing sector in the coming decade?

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter, or like our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? Featuring discussion, debriefs, video shorts, and webinar replays.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows 3D printed microfluidic device and needle. Photo via Boston Micro Fabrication.