Rapid Liquid Print (RLP), a 3D printing spin-off from the Massachusetts Institute of Technology (MIT), has raised $7 million in series A funding.

Based in Boston, RLP’s gel-dispensing technology enables the production of soft, pliable, and large-scale products in a matter of minutes. Currently, this technology is being used to 3D print parts for customers across a range of industries, including the medical, automotive and consumer goods sectors.

The company will leverage its new capital to scale its production capabilities, expand its employee base, and build additional business areas.

What is Rapid Liquid Printing?

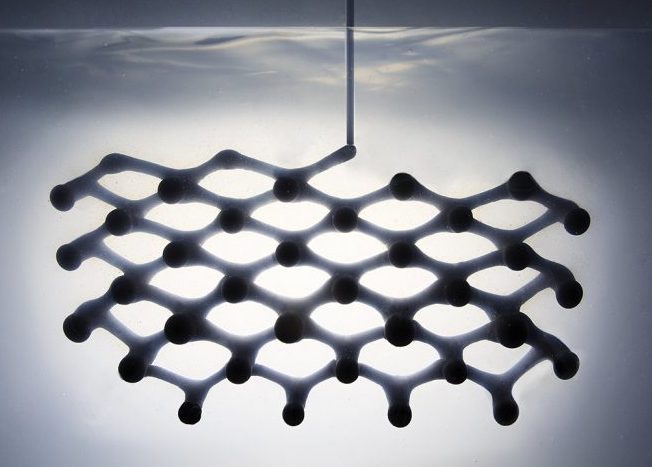

First introduced at Design Miami 2017, RLP’s technology allows 3D objects to be “drawn” within a gel suspension. Here, a liquid material mixture is injected into the gel, which holds the material in place as it is cured, negating the need for support structures. The 3D printing process is completed in a matter of minutes, with the final parts requiring minimal post-processing.

According to RLP, this process allows for the high throughput production of large-scale components with complex geometries. These parts can be 3D printed using industry-standard materials like foams, rubbers and silicones. The company claims that its process is superior to other elastomeric 3D printing technologies, as it is not restricted by speed or size limitations.

RLP also points to the sustainability benefits of its technology, with the gel able to be reused in multiple 3D print jobs. Moreover, parts 3D printed in silicone can be fully recycled at the end of the product life cycle.

Initially, RLP technology was targeted to interior design applications, such as the production of 3D printed furniture. However, the company has now expanded its reach, catering to the needs of researchers and companies requiring medical devices, footwear, home goods, aviation, and automotive components.

RLP raises $7 million in series A funding

Led by HZG Group, the financing round also drew backing from existing investors BMW i Ventures and MassMutual through its MM Catalyst Fund (MMCF).

This adds to HZG’s growing €60 million Tech Fund, which has a dedicated focus on 3D printing startups. The firm primarily targets Europe’s DACH region, with RLP representing only its second US investment.

RLP’s CEO and Co-founder Schendy Kernizan calls HZG Group, “an investor who recognizes the full potential of our technology and has its own track record of setting standards with the introduction of metal 3D printing on an industrial scale.” He believes that the new partnership will help take RLP’s technology “to the next level,” with the company benefiting from HZG’s expertise and connections in the tech space.

BMW i Ventures and MassMutual’s interest in RLP dates back to 2021 when they first provided the company with seed funding to expand its elastomer 3D printing product portfolio.

“With the HZG-Fund leading the Series A investment, we are thrilled to have found an outstanding partner renowned for their expertise in 3D printing. Teaming up with HZG and the visionary leaders at RLP, we are sure to create a winner in the space of elastomer 3D printing,” commented Marcus Behrendt, Managing Director BMW i Ventures.

“The unparalleled technology from RLP has accumulated significant interest, affirming its superiority. Their success in demonstrating the potential relevance of their technology in the automotive industry speaks volumes.”

Recent investment in 3D printing

2024 has already seen several 3D printing companies attract investment. In March, metal 3D printing startup Fluent Metal launched out of stealth after raising $5.5 million in venture capital funding.

The funding is being used to develop the firm’s drop-on-demand technology. This production-scale, wire-based, liquid metal printing (LMP) process is said to be completely waste-free, making it cheaper and more sustainable than powder-based 3D printing. Fluent Metal’s process is compatible with most metals, including heat-resistant refractory metals. It also fabricates complete parts in a single step, minimizing variability.

Elsewhere, Canadian 3D printing powder developer Equispheres secured an initial close on its Series B financing, raising approximately CAD $20 million. This funding round was led by Martinrea International, with INFOR Financial, and Stifel Nicolaus Canada acting as financial advisors. McCarthy Tétrault provided legal counsel throughout the financing process.

Equispheres atomization technology for metal powders is aimed at enhancing industrial additive manufacturing. Its aluminum powders can reportedly boost 3D printing speeds, enabling cost reduction.

The company will use its new finances to support the introduction of multiple new reactors this year, with a view to expanding its production capabilities. Equispheres also plans to improve its facilities and forge new partnerships to support the development of new materials.

Want to help select the winners of the 2024 3D Printing Industry Awards? Join the Expert Committee today.

What does the future of 3D printing hold?

What near-term 3D printing trends have been highlighted by industry experts?

Subscribe to the 3D Printing Industry newsletter to keep up to date with the latest 3D printing news.

You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.

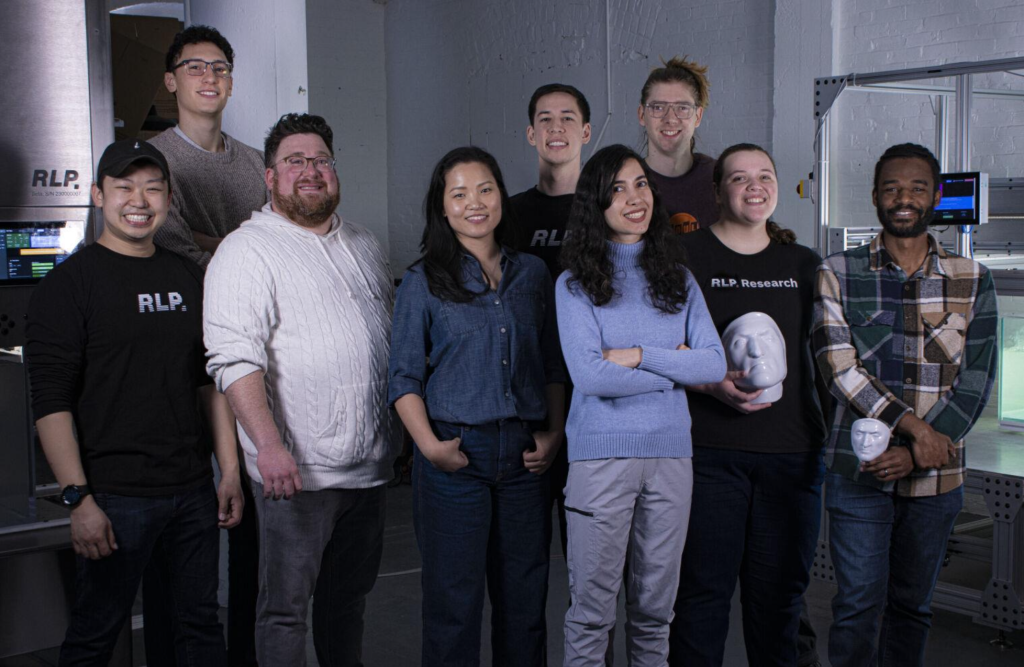

Featured image shows the RLP team. Photo via Rapid Liquid Print.