German consultancy AMPOWER has published its AMPOWER Report 2024, offering a comprehensive analysis of global AM industry developments in 2023 and forecasting trends for the next five years.

3D Printing Industry readers can now buy the 2024 AMPOWER Report at a 20% discount using the code “3DPI2024”.

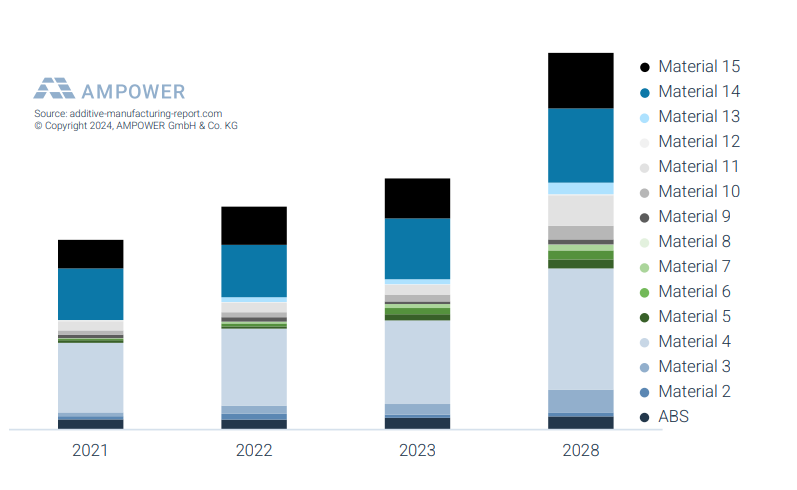

The report provides insights across the industry, including equipment, materials, and part manufacturing services. In 2023, the global industrial metal and polymer AM market size surged to €10.50 billion, marking a notable growth of 10.3% compared to the previous year. However, this growth rate represented a slight slowdown of the prior year’s outlook of approximately 18%. The slowdown was attributed partly to the modest growth of equipment suppliers, especially in the metal and polymer sectors, which saw an approximate 5% increase in 2023.

Despite the slowdown, the market is projected to witness steady growth, with an anticipated annual growth rate of 13.9%, reaching revenues of €20 billion by 2028. Notably, equipment suppliers in the Asia-Pacific (APAC) region foresee a rebound in the market, expecting an annual growth rate of around 16% until 2028.

Dr. Maximilian Munsch, Co-Author and Partner at AMPOWER said, “Aerospace and defense are currently the strongest market drivers due to the new space race as well as increasing global investments into defense programs.”

![Global metal and polymer AM market 2020 to 2023 and forecast 2028 [EUR billion]. Image via AMPOWER.](png/screenshot-2024-04-30-101148.png)

Sector-specific analysis

Metal powder bed fusion (PBF) systems accounted for 40% of sales revenue in 2023, while polymer PBF contributed just over 10%. The report notes that while not all principles have reached the necessary maturity for industrialization, the drive for innovation persists, leading to an increase in AM technologies. However, funding for 3D printing startups experienced a decline in 2023 due to a scarcity of worldwide venture capital. Additionally, claims made by founders in the AM sector are under scrutiny as many startups fail to deliver promised profitability years later, explains the report.

Both buyers and suppliers had anticipated higher unit sales for 2023, indicating a challenging market environment as projections were not met. PBF productivity saw a continuous increase, with even entry-level systems featuring dual laser configurations to boost output performance. However, user forecasts sometimes exceeded actual production capacity, leading to longer periods of contentment with existing systems before considering additional purchases.

![Trend of metal PBF equipment sales 2018 to 2023 and forecast 2028 [units]. Image via AMPOWER.](png/screenshot-2024-04-30-101209.png)

The report highlights robust growth in the aerospace and defense sectors, with a 30% increase over the past two years. Anticipated increases in global defense budgets are expected to drive AM adoption in these industries. In contrast, the automotive sector’s investment in AM equipment stagnated, with further growth dependent on high-volume AM technologies reaching industrial maturity.

In the dental industry, the adoption of AM remains strong, particularly in customized applications such as aligner molds and metal dental restorations. The industrial sector is projected to lead in equipment spending by 2028, utilizing a variety of AM technologies.

In terms of polymer AM, the feedstock market grew by over 12% in 2023, with continuous growth expected due to increasing system productivity and a growing system base. PA12 powder remains the dominant material, albeit with low material efficiency due to the need for a high refresh rate. According to the report, flexible TPU material is also increasing its share, particularly in consumer goods and industrial applications.

Recent developments in the AM sector

Elsewhere, market intelligence firm CONTEXT reported that industrial 3D printer shipments hit a wall in the second half of 2023. While overall shipments stagnated in the second half of 2023, the decline was particularly pronounced in the polymer segment. Global shipments of industrial polymer 3D printers plummeted by 17% YoY in Q3, whereas metal printer shipments witnessed a more moderate decrease of 3%.

Moreover, as a part of the 2024 3D Printing Industry Executive Survey, insights from 3D printing experts were shared regarding emerging trends and the trajectory of 3D printing. Key observations emphasized by industry professionals encompassed the rising adoption of 3D printing across diverse sectors and emerging markets, the expanding significance of additive manufacturing in addressing supply chain obstacles, and the increasing utilization of 3D printing for consumer goods manufacturing.

Additionally, the survey revealed a prevailing sense of optimism among participants regarding the economic prospects of 3D printing in 2024. The majority of respondents viewed the economic landscape for 3D printing favorably, with 62% expressing positivity towards external conditions, with an additional 68% indicating favorable or very favorable perceptions of internal business conditions.

Access the full analysis and get the 2024 AMPOWER Report at a 20% discount, click here and use code “3DPI2024”.

What 3D printing trends do the industry leaders anticipate this year?

What does the Future of 3D printing hold for the next 10 years?

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter, or like our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? Featuring discussion, debriefs, video shorts, and webinar replays.

Join the Expert Committee for the 2024 3D Printing Industry Awards to help select the winners!

Featured image shows global metal and polymer AM market 2020 to 2023 and forecast for 2028 [EUR billion]. Image via AMPOWER.